The link between global events and financial markets can be complex. The twists and turns resulting from events such as political unrest and economic turbulence can have a substantial impact on the financial world, leaving investors on edge. Geopolitical instability, for example, can create uncertainty and cause investors to be unsure about the potential impact on their investment performance.

During these uncertain times, it is important to understand the dynamics of market reactions to global conflicts – the more you understand how such events can impact your investment performance, the better prepared you will be to handle investing through any short-term fluctuations.

Understanding Market Dynamics Amid Global Uncertainty

Looking back at past situations of geopolitical unrest provides valuable insight into market behavior during these times. Even if major events initially impacted markets, research indicates that their long-term effects have been minimal.

WWII & The Great Depression

World War II and the Great Depression triggered major market crashes, with stocks dropping to all-time lows. When the Great Depression began in 1929, stock prices plummeted by nearly 90% over a four-year period. Similarly, the outbreak of World War II led to widespread panic selling, resulting in initial sharp declines in stock prices and market indices.

Despite the severity of these crashes, historical data reveals that markets eventually recovered, often surpassing their pre-crisis levels.

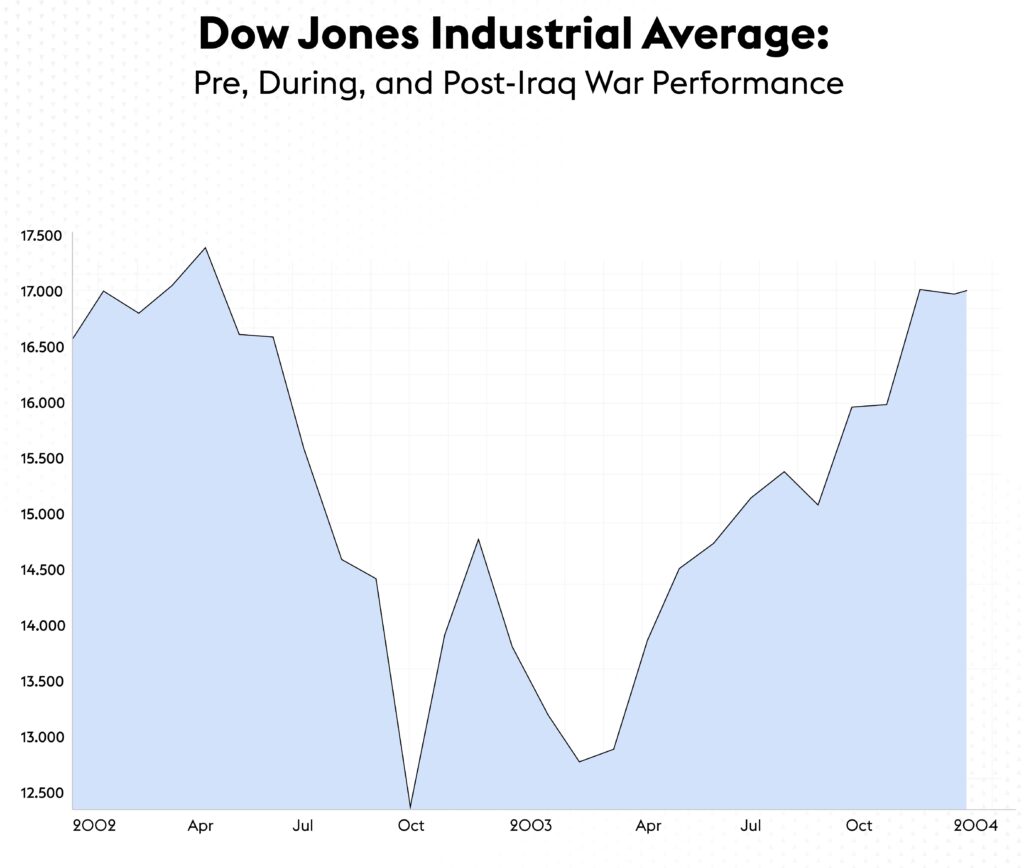

Iraq War 2003

During the Iraq War in 2003, markets dropped greatly in the first six weeks of the conflict. However, the market slowly began to recover from its 2003 low, as can be seen in the chart below.

Russia-Ukraine War 2022

After Russia invaded Ukraine, global markets took a hit. In the US, the S&P 500 index dropped more than 7% following the invasion. This was due to the placement of severe economic sanctions on Russia and worries about the prices of goods and energy rising as a result. However, as seen in the chart below, markets rebounded within a month, with the S&P trading higher than before the invasion.

What Should You Do with your Investments?

In times of uncertainty, having a strong investment strategy is essential. To begin with, ensure that your investments are diversified across various industries and geographical regions. This helps mitigate the effects of market volatility and reduces exposure to specific risks associated with global events.

Alongside this, investing fixed amounts on a regular basis allows investors to benefit from dollar-cost averaging (DCA). With this approach, investors purchase assets at different price points, which can decrease the average cost over time. By adopting this method, people can benefit from market downturns, as seen during periods of political unrest.

One of the biggest misconceptions when investing is thinking that selling your investments when the market goes down will prevent you from losing more money. Historically, the market has rebounded after any downturn and has trended upwards in the long run. Holding your investments over time and waiting for the market to recover may allow the recovery of “paper losses” and help you gain more in the long term.

Stay Calm and Focus on the Long Run

While global events may cause short-term market fluctuations, markets have historically recovered eventually and continued to rise over time. Investing in a passive investment plan, such as those provided by SmartWealth, helps you spread your investments across a variety of asset classes, countries, industries, and companies, ensuring that your investments stay resilient in the face of market volatility.